How 1031 Exchanges Compare to Stock Market Investing

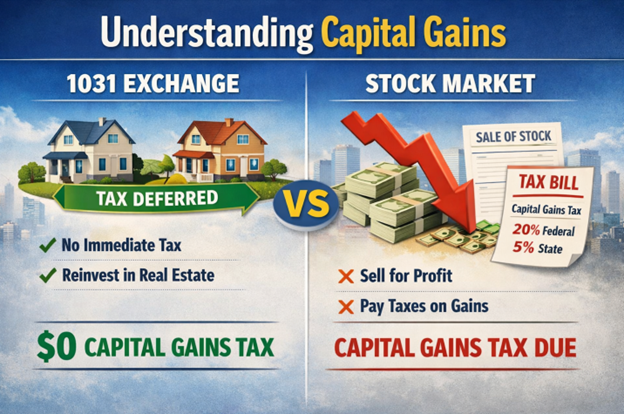

Capital gains play a major role in how much wealth an investor ultimately keeps. Two investments can generate the same return on paper, yet produce very different outcomes after taxes. This difference becomes especially clear when comparing real estate investing to the stock market.

For property owners, capital gains are not just a tax issue. They are a planning consideration that shapes long term investment strategies. Understanding how capital gains are treated in real estate, particularly through a 1031 exchange, helps explain why many investors favor rental properties over stocks when building sustainable wealth.

How Capital Gains Work in the Stock Market

Capital gains occur when an asset is sold for more than its purchase price. In the stock market, those gains are realized immediately upon sale. There is no ability to defer the tax, even if the investor reinvests the proceeds.

Most stock investors face long term capital gains taxes of 15 to 20 percent at the federal level. Higher income investors are also subject to the 3.8 percent net investment income tax. State taxes apply on top of that, which can significantly reduce net returns depending on location.

In high tax states, investors can lose more than one third of their gains. A $100,000 profit from selling stocks may result in only $63,000 kept after taxes. This structure limits flexibility and makes it difficult for investors to reposition portfolios without shrinking their capital base.

Capital Gains in Real Estate Are Structured Differently

Real estate follows a different tax framework. Property owners who sell investment real estate are generally subject to capital gains tax and depreciation recapture. However, Section 1031 of the IRS tax code allows those taxes to be deferred when the proceeds are reinvested into another like kind investment property.

A 1031 exchange allows investors to sell a property and reinvest the full sale proceeds into a replacement property without paying capital gains taxes at the time of sale. This does not eliminate the tax, but it postpones it indefinitely as long as the investor continues exchanging.

For example, an investor who purchased a property for $500,000 and sells it for $1 million generates a $500,000 gain. Without a 1031 exchange, taxes could exceed $180,000. With a properly executed exchange, the investor reinvests the entire $1 million into a new rental property.

Over time, this ability to keep capital fully invested creates a powerful compounding effect. That’s the reason for the saying, “1031 until you die.”

Why Tax Deferral Changes Investment Outcomes

Tax deferral is one of the most significant advantages real estate offers over stock market investing. When capital remains invested, it continues producing income and appreciation. Stock investors must sell, pay taxes, and reinvest a reduced amount, which slows long term growth.

This is why rental properties remain a core investment strategy for many property owners. Deferred taxes allow investors to scale portfolios, improve cash flow, and upgrade asset quality without resetting progress after each sale.

In addition, heirs may benefit from a stepped up cost basis, which can eliminate deferred capital gains entirely under current tax law.

Leverage Amplifies Capital Gains in Real Estate

Leverage further separates real estate from stocks. A $100,000 investment in stocks controls $100,000 of assets. In real estate, that same $100,000 can often control a $500,000 property through financing.

If that property appreciates by 5 percent, the gain is $25,000. That represents a 25 percent return on invested cash. A stock portfolio would need to rise 25 percent to produce the same dollar gain.

When leverage is combined with 1031 exchanges, property owners can roll gains into progressively larger investment properties without triggering capital gains taxes, accelerating long term portfolio growth.

Stability and Inflation Protection

Real estate also provides predictability that stock market investing often lacks. Rental income is driven by leases, not daily market headlines. Long term leases create reliable cash flow, while ownership of a physical asset provides intrinsic value.

Inflation tends to favor real estate investors. As prices rise, rents and property values typically increase as well. Mortgage payments remain fixed, allowing operating margins to expand over time. This dynamic makes commercial real estate and net lease investments particularly attractive during inflationary periods.

Executing a 1031 Exchange Requires Planning

A successful 1031 exchange requires precision. Investors must identify replacement properties within 45 days of selling and close within 180 days. Missing either deadline results in full capital gains taxation.

Because of these constraints, many property owners focus on replacement properties that offer long term leases, strong tenants, and minimal management responsibilities. Single tenant net lease properties are often preferred due to their simplicity and stability.

Ready to Apply This Strategy to Your Portfolio

Understanding capital gains only matters if you can act on it correctly. Executing a 1031 exchange and selecting the right replacement property requires experience, speed, and access to quality opportunities.

At 1031tax.com, we help property owners purchase single tenant net lease properties with strong national tenants. Our focus is on NNN investments that provide predictable cash flow, minimal management responsibility, and long term lease stability. Whether you are selling apartments, retail centers, or other investment properties, we guide you through the exchange process and help you secure replacement properties aligned with your financial goals.

To learn more about purchasing NNN properties or executing a 1031 exchange, visit https://1031tax.com and explore available opportunities.