1031tax.com will help you purchase NNN Triple Net Property

written by alan fruitman

The NNN Triple Net Property Book

“The NNN Triple Net Property Book” was written for buyers of single tenant NNN property. You will learn the following about NNN property and real estate investing: pros and cons of NNN property, passive income, investment goals, importance of location and the tenant’s credit rating, cap rates, building a diversified portfolio, whom your broker represents, environmental issues, ground leases, the difference between NN and NNN leases, franchise vs. corporate leases, what a letter of intent is, why a letter of intent matters, the 96% rule, timeline of the purchase, importance of estoppel certificate, 1031 exchange information, receiving NNN properties from 1031tax.com and much more.

“The NNN Triple Net Property Book” is a tremendous resource and a must read for 1031 exchange, 1033 exchange, and income property investors who want to own NNN leased investment property with long-term triple net leases.

Services

We do the property search for you

Alan Fruitman and the team at 1031tax.com receive more than 100 single tenant NNN properties every day from our network of owners, developers and other real estate brokers. Most of our NNN triple net leased properties (and NN double net lease income properties for sale) are “pre-market” or “first day on the market.” Every property is analyzed based on location (primary retail corridor), demographics, lease terms and tenant’s credit.

1031tax.com will email the best fee simple or ground leased NNN properties to you before most other investors see them.

Location Matters

Location matters when you purchase a NNN property. Strong demographics and a prominent parcel are keys to long-term success. The property should have more than enough nearby residents who need the product or service that your tenant provides. The property should have strong visibility from the main road and easy access for customers to enter (ingress) and leave (egress). In addition, a location close to many other tenants has the advantage of being a destination for shoppers. For example, a strong retail property would be located on a prominent street with surrounding tenants such as Chase Bank, Wells Fargo, Walgreens, CVS, Wal-Mart, Home Depot, Lowe’s, McDonald’s, Chipotle, O’Reilly, AutoZone, 7-Eleven, etc.

Strong Guarantee

Property owners sleep well at night when their tenant is financially strong. This is why a strong tenant is often the first item on an investor’s criteria list. Fortunately, many NNN properties are leased by companies that are considered “Investment Grade” by Standard & Poors. These companies often have a multi-billion-dollar market capitalization. Examples include Walgreens, CVS, Starbucks, McDonald’s, Chipotle, Chase Bank, Wells Fargo, AutoZone, Home Depot, Dollar General, Target, and other brand name retail tenants. (Market capitalization is the value of a publicly traded company. Value equals the total shares times the current market price of each share.)

Prominent Location

Having a strong tenant is certainly important. However, a prominent location should be an investor’s most important criterion. Here’s why: Over time, a property with a prominent location and average tenant will trump a property with an average location and a great tenant. Fortunately, many NNN properties are located in a prominent location.

1031 Exchange Until You Die

Most people have heard the saying, “Nothing is certain except for death and taxes.” 1031 exchange is the exception.

When investment property that has appreciated in value is sold, there will be a tax liability. However, under current tax law, if you or your children inherit investment property, the property will have a stepped-up basis. Stepped-up basis means the property value is readjusted to the current market value, not the price the property was purchased for. Depending on the value of the estate, you or your children may not have any tax liability when property is inherited.

Buy and Hold

Although some investors purchase a NNN property and sell it for a quick profit, most NNN property investors hold their property for many decades.

Think like Warren Buffet, who is famous for buying stock in a quality company and almost never selling it. He is not focused on how the value changes from year to year. Mr. Buffet is confident that a quality company will prosper and continue to prosper.

The same long-term principle is true – along with the additional security from the underlying real estate – for NNN property. If you purchase a NNN property with a quality tenant and location, it is very likely that your tenant will fulfill all lease obligations. In addition, when your tenant eventually vacates, the quality property you purchased many years earlier should be significantly more valuable (assuming market rents have risen).

Passive vs Active Income

Passive income is the financial reward for good planning. Passive income from a single tenant NNN property is guaranteed money you receive in your mailbox every month, for 10 to 25 years (often longer), without worrying about vacancy, property management, leaky roofs, clogged toilets, taxes or insurance. Investors purchase NNN property to provide passive income for their family and to fund their retirement. NNN property also will be an anchor in the financial legacy you leave when you pass.

The opposite of passive income is active income. Active income is money you receive from your day job or “hands-on” investments such as apartment buildings, office buildings and shopping centers. It takes a significant amount of time and energy to produce active income.

NNN Properties

Nationwide Tenants

NNN Property tenants are often “Investment Grade” by Standard & Poors. Tenants often have a multi-billion-dollar market capitalization.

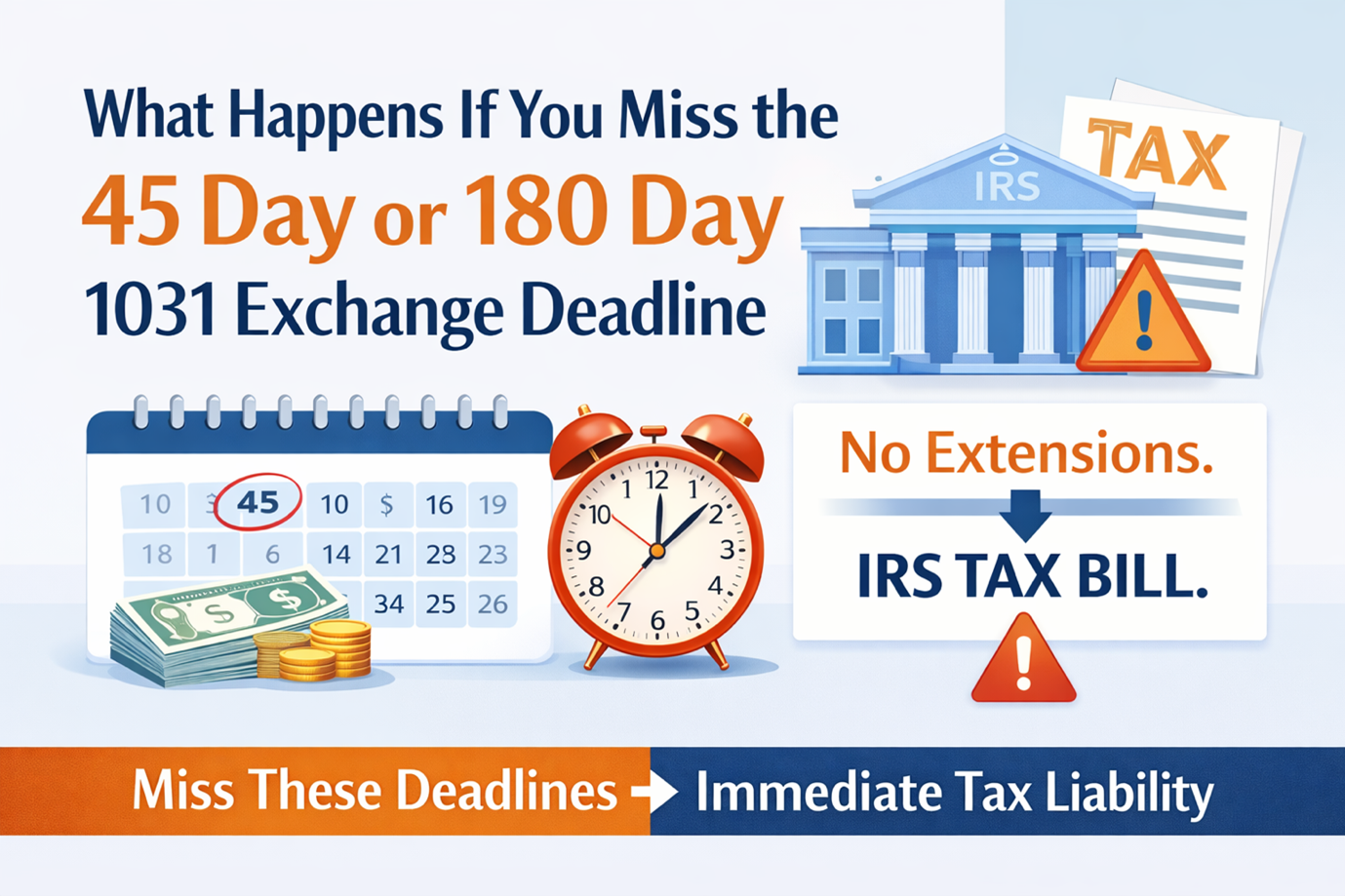

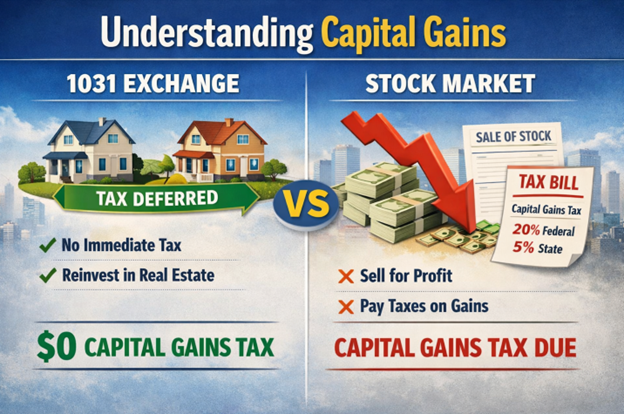

Four Reasons Why Investors Utilize 1031 Exchange

#1

Reason #1 is to defer both Capital Gains and Depreciation Recapture Tax.

#2

Reason #2 is to consolidate. Whether you own rental houses, apartment buildings, shopping centers or any other combination of investment properties, consolidating may make your life easier. For example, you are able to sell multiple properties and 1031 exchange into fewer properties.

#3

Reason #3 is to diversify. If all of your properties are in one asset class (residential, commercial, etc.), you can diversify your portfolio by selling some of the properties and 1031 exchanging into another asset class. In addition, if all of your properties are located in one geographic area, you can diversify into other locations.

#4

Reason #4 is to simplify your life. If you own management-intensive property, you can 1031 exchange into NNN property and leave all maintenance and repairs to your tenant.

Meet Our Team

Alan Fruitman

President/Lead Broker

Geoff Hauer

Independent Broker

Tami Smith

Property Analyst

Renee LaPine

Transaction Manager

Alisa Fierro

Property Analyst

Testimonials

“Finally, a book that helps explain how this all works in plain English! Alan’s book is accessible by anyone – including recovering lawyers like myself – and that’s saying something.”

“I’d recommend this for anyone interested in learning more about buying NNN property.”

Patrick S. Ryan, J.D., Ph.D.

Strategy & Operations Principal at Google Inc.

“Alan Fruitman has a tremendous relationship with his buyers and he works harder and faster than anyone in the NNN business. I have had the privilege of working with Alan Fruitman on many transactions. I call Alan before I bring my NNN properties to market.”

“Every time I call, Alan has a quality buyer who purchases my property.”

Sam Zaitz

Legend Retail Group

“Read your book in one sitting and really enjoyed it. I have been investing in NNNs for several years and I appreciated the insights. The book answered some questions I have had for a while. Well done! Congratulations!”

Robert Brauer

“I have worked with Alan Fruitman for more than 15 years and have referred several of my clients to him for real estate services in addition to purchasing several properties of my own. Alan’s attention to detail, knowledge, and professionalism are the reasons for his longevity and success in the real estate business.”

“It is with the utmost confidence I will continue to refer my clients to Alan.”

Todd K. Schiff, CPA

“Alan Fruitman with 1031tax.com made the purchase of our first NNN property very simple, quick and comfortable. Alan was always available by phone or email and got back to us the same day, even on the weekend. Alan answered questions about various properties, terms and the process of buying a NNN property.”

“We really liked receiving the new property emails and the property brochures we requested. We would definitely contact Alan Fruitman and 1031tax.com when we buy another NNN property.”

“Thank you very much for helping us purchase a stress-free property.”

private

“I am grateful to know and have Alan Fruitman represent our family’s investments in commercial real estate. His wisdom and advice in this area are un-matched. Rather than being driven for the closing so he would be paid, I found Alan intense to represent me well. His thorough analysis is unmatched. He is passionate about representing his client and the best interests of his client.”

“This book is just another example of his desire to educate his clients.”