Understanding 1031 Exchange Deadlines

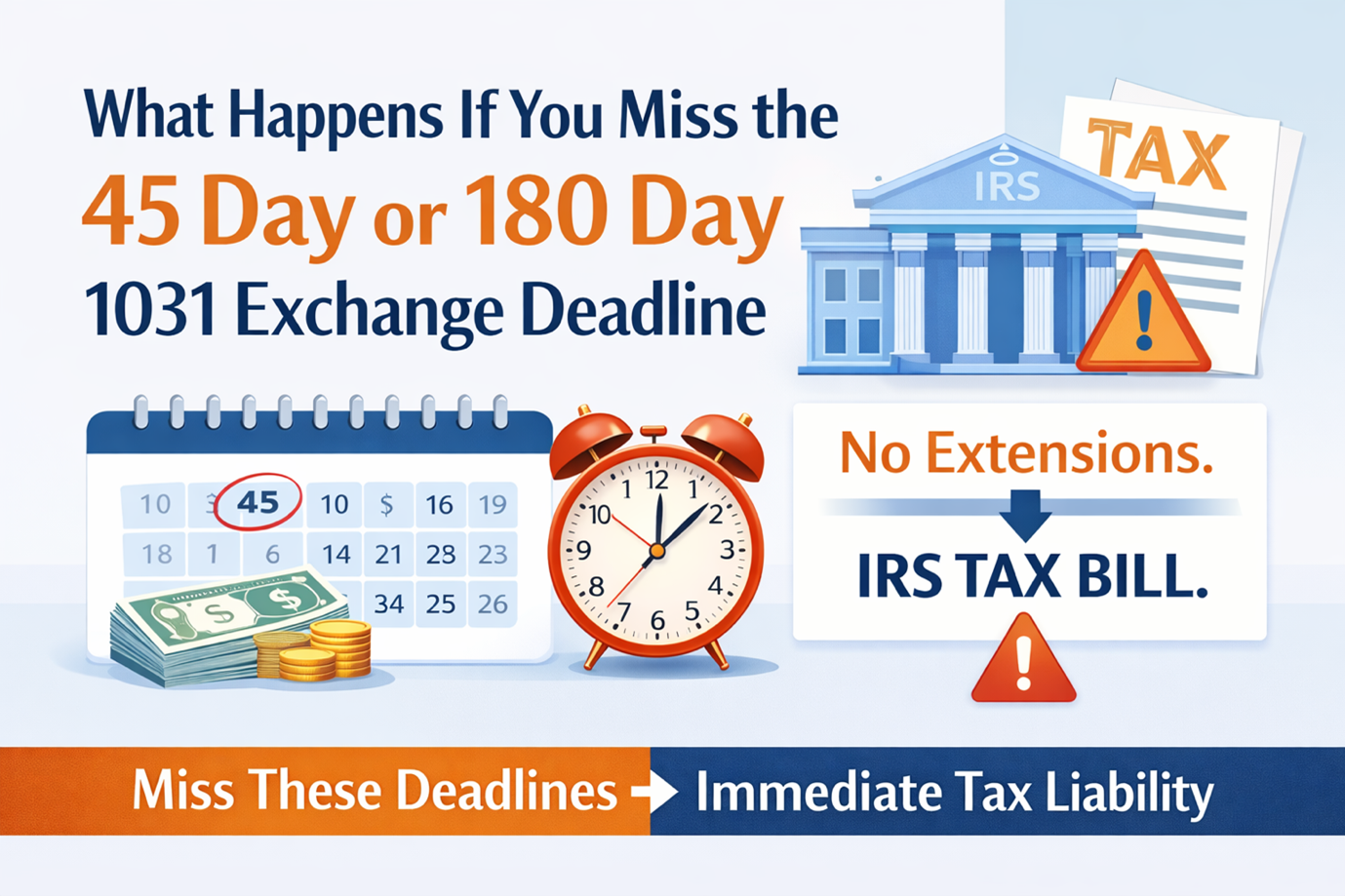

The 1031 exchange process depends on strict timelines set by the IRS. Property owners who fail to meet either the 45-day identification deadline or the 180-day exchange completion deadline face immediate and unavoidable tax consequences. Missing these deadlines transforms what should have been a tax deferred exchange into a fully taxable event.

These deadlines exist to prevent indefinite tax deferral and ensure proper IRS compliance. Understanding what happens when deadlines are missed helps property owners take the process seriously and plan accordingly.

The 45-Day Identification Deadline

The 45-day identification deadline begins the day after the relinquished property closes. Property owners must submit a written list of potential replacement properties to their qualified intermediary within this window. The IRS allows identification of up to three properties of any value or unlimited properties as long as their combined value does not exceed 200% of the relinquished property value.

If the 45-day deadline is missed, the entire 1031 exchange fails. There are no extensions, waivers, or exceptions. The sale proceeds become fully taxable, and capital gains taxes are due on the transaction. This rule catches many sellers off guard, especially those who underestimate how difficult it is to find quality replacement properties in competitive markets.

The 180-Day Exchange Completion Deadline

The 180-day exchange completion deadline also begins the day after the relinquished property closes. Property owners must close on at least one identified replacement property within this period. The 180-day deadline runs concurrently with the 45-day identification period, meaning sellers only have 135 days after identification to complete the purchase.

Missing the 180-day deadline results in the same outcome as missing the 45-day deadline. The exchange fails, and the sale becomes a taxable event. The IRS does not grant extensions for financing delays, title issues, or seller side complications.

No IRS Waivers or Extensions

The IRS does not provide waivers, extensions, or exceptions for missed 1031 exchange deadlines. Inadequate planning, lender delays, and seller side issues are not valid reasons for relief. Once a deadline passes, the exchange fails permanently. This strict enforcement exists because the 1031 exchange is a tax deferral benefit, not a tax elimination strategy.

Financial Consequences of a Failed Exchange

When a 1031 exchange fails due to missed deadlines, the financial impact can be substantial. Capital gains taxes apply to the entire sale amount. Depending on the property value and tax bracket, this could mean losing hundreds of thousands of dollars in deferred taxes.

A failed exchange forces immediate payment of these taxes, reducing available capital for reinvestment. Sellers who planned to reinvest full proceeds into larger properties must now purchase smaller assets after paying taxes. This reduces portfolio growth and limits cash flow potential.

Why Advance Preparation Is Essential

The strict nature of 1031 exchange deadlines makes advance preparation essential. Property owners should never list a property intended for a 1031 exchange without first developing a realistic replacement property strategy. This includes identifying target markets, understanding financing requirements, and working with experienced advisors who can execute the exchange efficiently.

Consulting with a qualified intermediary before listing ensures proper documentation and compliance with IRS requirements. Sellers should also begin identifying replacement properties before their relinquished property closes to reduce the pressure of the 45-day window.

The Importance of Working With Experienced Advisors

Navigating the complexities of a 1031 exchange requires experienced advisors who understand the process. A qualified intermediary ensures proper handling of sale proceeds and compliance with IRS rules. Real estate professionals with 1031 exchange experience help identify suitable replacement properties and negotiate transactions within tight timelines.

Tax advisors provide guidance on financial structuring and debt replacement requirements. Lenders familiar with 1031 exchanges expedite financing and avoid delays that jeopardize deadlines. Without this team of experienced advisors, property owners increase the risk of costly mistakes and failed exchanges.

Realistic Replacement Property Strategies

Developing a realistic replacement property strategy before listing reduces the risk of missed deadlines. Property owners should identify multiple potential replacements rather than relying on a single option. Having backup options provides flexibility when market conditions change or sellers withdraw properties.

Single tenant net lease properties are often favored in 1031 exchanges because they offer predictable cash flow, long term leases, and minimal management responsibilities. These properties are easier to evaluate and close quickly, which helps meet tight deadlines.

Protect Your 1031 Exchange Investment

Missing the 45-day or 180-day deadline results in a failed 1031 exchange and immediate tax liability. The IRS offers no waivers or extensions. Property owners who fail to plan properly face significant financial consequences.

Avoiding these outcomes requires advance preparation, realistic replacement property strategies, and experienced advisors who understand the complexities of 1031 exchanges. Starting the process early and identifying multiple backup options protects tax deferral benefits.

At 1031tax.com, we specialize in helping property owners execute successful 1031 exchanges and acquire high quality single tenant net lease properties. We focus on NNN investments with strong national tenants. Our experience with 1031 exchange timelines ensures you never miss a critical deadline.

Do not risk a failed exchange due to poor planning or missed deadlines. Visit https://1031tax.com today to explore available NNN properties and learn how we can help you execute a successful 1031 exchange.